As we wrap up October, it’s time to look back at the key developments that shaped this month on Amazon and across the broader e-commerce landscape.

From Prime Big Deal Days results to major Amazon Accelerate announcements and the growing impact of AI-driven shopping, October brought important insights and shifts that will influence Q4 and beyond.

Here’s a recap of what mattered most this month:

Prime Big Deal Days Delivers Mixed Results

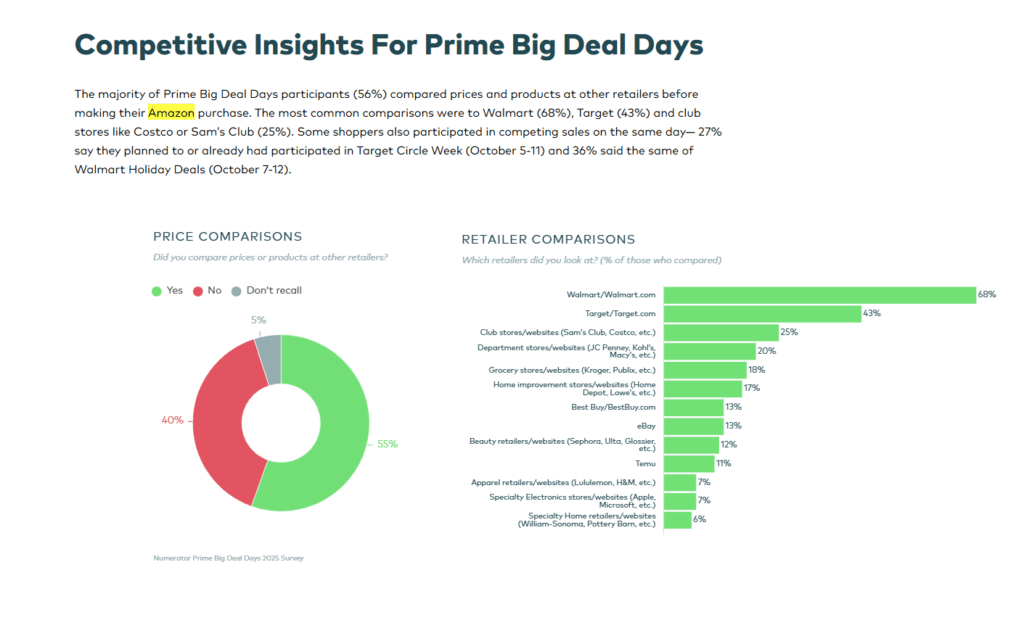

Amazon’s October Prime Big Deal Days showed slower performance than previous events, with industry observers noting muted shopper enthusiasm.

Several factors may have contributed: Concern over Tarifs, concurrent sales at Walmart and Target splitting traffic, and the emergence of new AI-powered shopping channels shifting consumer behavior.

For sellers, this underscores the need for sharper competitive positioning and genuine value as shoppers are increasingly sophisticated in evaluating deals across platforms.

Amazon Accelerate Delivers Key Operational Updates

Amazon’s annual Accelerate conference (September 16-18) introduced several game-changing tools for sellers:

Seller Assistant Gets Agentic AI: The upgraded assistant now uses agentic AI to proactively monitor Account Health, flag risky listings before they become violations, and apply fixes with seller approval.

It continuously scans for compliance issues, like product descriptions that inadvertently trigger safety regulations, and can implement solutions automatically when authorized, helping sellers avoid costly suspensions.

Custom Analytics Workspace: Amazon launched Custom Analytics, a free drag-and-drop workspace consolidating over 100 metrics previously scattered across 15+ reports.

Sellers can now visualize sales, traffic, inventory, and promotions data with heat maps and funnel diagrams, making it easier to spot trends and diagnose performance issues in one unified dashboard.

End of FBA Commingling: Later this year, Amazon will phase out inventory commingling – the practice of pooling identical items from different sellers.

The shift to “stickerless” tracking means customers receive products from the specific seller they purchased from, eliminating counterfeit risk and saving sellers an estimated $600 million annually in re-stickering costs.

Brand owners no longer need to apply FNSKU labels to protect inventory integrity.

The Bottom Line

October’s updates mark a clear shift in the e-commerce landscape.

Amazon Prime Big Deal Days’ slower performance reflects a more mature marketplace where shoppers are increasingly strategic – comparing prices, leveraging AI tools, and seeking genuine value over blanket discounts. At the same time, the rise of AI-driven shopping such as ChatGPT’s Instant Checkout highlights a growing shift in discovery and purchase behavior beyond Amazon.

While Amazon’s decision to block AI crawlers protects its ecosystem, it also leaves space for competitors to capture early conversational commerce traffic, making multi-channel readiness more critical than ever. Finally, the new tools unveiled at Amazon Accelerate show continued investment in automation and analytics, giving sellers stronger visibility and control.

At Wise Commerce, we stay closely aligned with these changes to help our partners adapt quickly, optimize performance, and stay ahead of evolving market trends.